REVIEW

Analyze all three of your credit bureau reports. We then work with you to identify questionable negative item(s) that may be hurting your credit score.

DISPUTE

We get to work and challenge negative item(s) with the bureaus and if required, your creditors too. Let’s just say, we do not like taking no for an answer and will fight for you.

TRACKING

We closely monitor your progress, making sure any additional issues are addressed accordingly to help reach your credit goals.

![]()

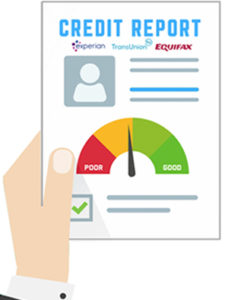

Keeping Track

Whether you are at home or on the move, you will have 24/7 access to all the information you need to keep track of your progess. From updates, score tracking, current status and much more

Why Credit Matters

Buying a Home

Higher credit score helps you qualify for the best mortgage rate. Lower rates can potentially save you hundreds, if not thousands of dollars each month.

Applying for Rental

The Landlord or Property Manager will require a credit report. Excellent credit could help differentiate you from the crowd of applications, while poor credit could rule you out, or require a higher deposit down.

Credit Cards

To qualify for top credit cards – with generous sign up bonuses and travel rewards – generally requires good or excellent credit, along with higher credit limits.

STARTING A NEW BUSINESS

If your score is between 300 and 629, banks will most likely reject your small-business loan application. Bad credit could limit your funding and make it that much harder.

BUYING AND INSURING A CAR

If you have a low credit score, you will likely have to pay a higher interest rate or worse, your car loan application could be rejected altogether. Most states let insurers weigh credit scores when setting rates. Lower the credit score can mean higher cost for auto coverage.

Getting Hired

For jobs involving access to money, sensitive customer data or company information, some employers check the credit for potential hires. Having a lower credit score may not give the greatest first impression to an employer.

Future Homebuyer

I was trying to get qualified for a home loan and since my wife and my credit were in the low 600’s we couldn’t qualify and even if we did the interest rates were to high to make the payments work for us. Now 2 months in with Credlii and both my wife and I can can see crazy results. Our score is in the low 700’s but we’re going for mid 700’s to try and get a good rate on our home loan so we can afford a condo. We’re excited to one day be a homeowner all thanks to Credlii.

Score Kept Going Higher

I was skeptical at first and sounded to good to be true. From time I signed up and in a matter of 3 weeks, I started seeing my credit score go higher and higher. The team at Credlii was able to remove some negative items from all 3 credit bureaus. Thanks Credlii!

Numbers Don’t Lie

Shout out to Credlii. They are the truth! I was in the 500’s and we stuck to the plan and in a matter of a few months they were able to get me in the 700’s. I was young and irresponsible with some late payments in the past. I can see the difference from having bad credit to excellent credit, while saving me literally thousands on getting a better interest rate. They working on my cousin’s credit now and she already seeing results.

From 500s to 700s

Was a client for about 4 months and before I found Credlii my credit was in the mid 500’s due to some poor judgement. But after working with Credlii they put me in the mid 700 range. I fully trust them and would recommend them to any of my family or friends.

Big Difference

I tried using another company in the past without any improvements to my credit. Decided to give it one more try and use Credlii. Glad I found these guys, they were quick and respond right away. I’m already seeing changes to my credit report, and also helped me get a new credit card which is boosting my credit even more. Highly recommend Credlii to anyone looking to fix their credit.

Couldn’t Believe It

I was skeptical at first. Since I tried repairing my credit on my own and failed. Not sure how Credlii did it, but the same items I was trying to remove, they were able to do it in about 40 days or so. Was super stoked. Thanks Credlii!

Corey

Corey

Great Service

It’s only been a few weeks, but I’m already seeing positive results! Thanks Credlii!

Recent Comments